INTRODUCTION:

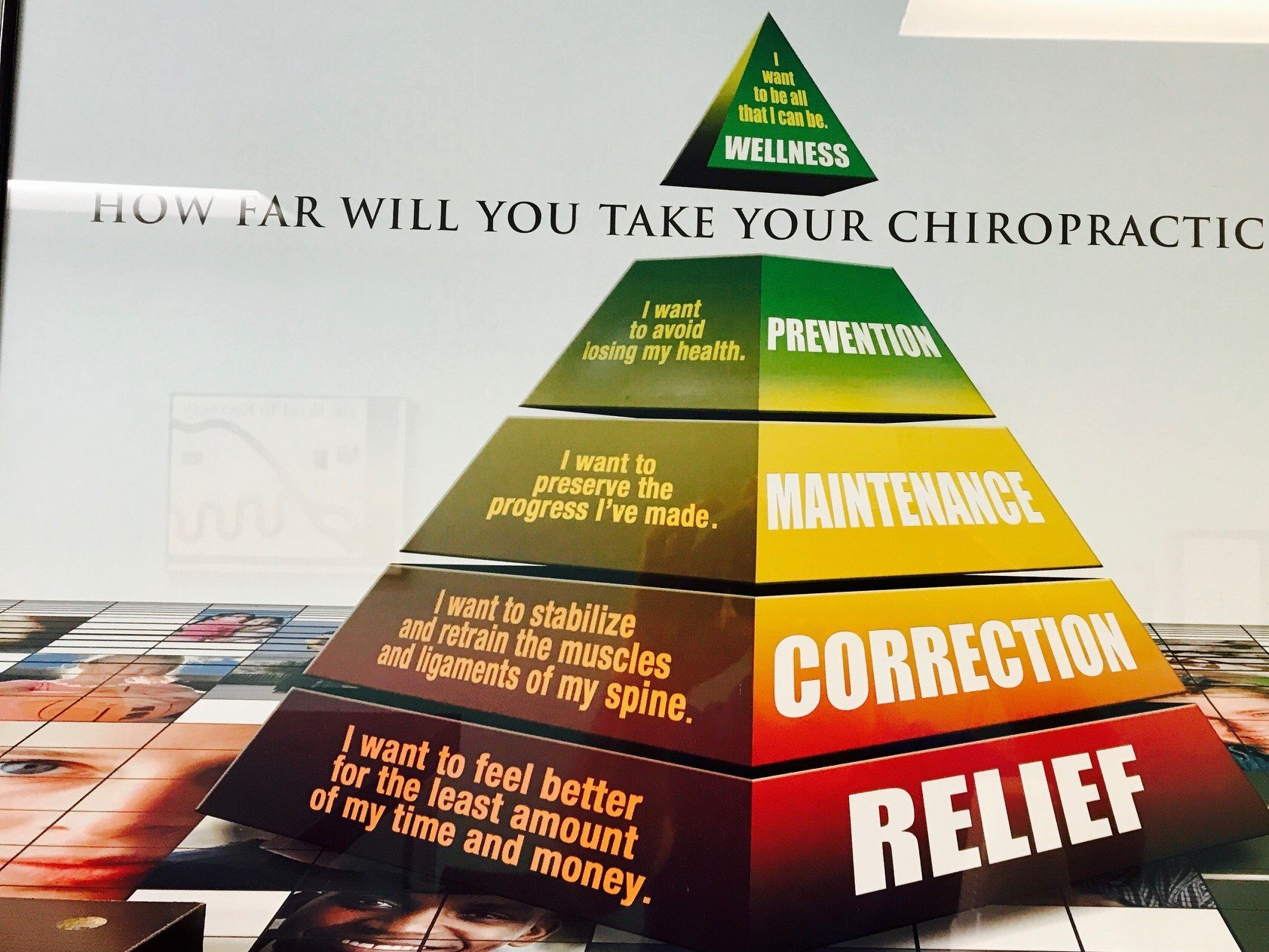

Recently when I was sitting at my chiropractor's getting my back seen to, the poster on the wall below got my attention. You see, if you look at this picture it is quite possible that you could also replace the word 'chiropractic' with 'business'. Businesses that have pain points will generally need some sort of help just like a person with a sore back needs help from a chiro.

Let's have a look at how the relationship you have with your back can also be applied to your business.

(Photo courtesy of Simon Gilsenan Moss Vale Chiropractic Centre & Bondi Junction)

1: RElief

If your business is in pain, the first thing will be to seek relief. Getting some paracetamol might be good for a start. So if it's cash flow is the issue a loan or capital injection might fix you for now.

2: Correction

A short term fix such as a loan might have given your business some relief but without correcting the problem chances are you are just going to find yourself in the same position in the not so distant future meaning you have to borrow again. Correcting the problem can include:

- making a bigger profit;

- reducing dividends;

- minimising loan repayments;

- fixing margins;

- increasing revenue through creating more leads and better conversion rates;

- cutting costs;

- invoicing as you go;

- finding better trading terms;

- reducing tax.

Figure 2: You don't want your business to be the lead of the Hunchback Of Notre Dame!

3: maintenance

You've gone down the relief and correction tracks but if you don't keep maintaining the business, all the good work you've done may see you fall back again if you're not careful. Having regular meetings with your small business accountants Sydney & Dubbo will help you check that everything seems to be in order and on track with your 3 way budget and actual reports.

4: Prevention

We all know prevention is better than the cure or so the saying goes. When you sit down and plot the path you want your business to take, what are some of the things that you can put in place that will help ensure you are preventing cash flow problems into the future? This is all about having solid systems in place that help ensure cash flow stays positive.

Avoid:

- the wrong type of customer that costs you time and money;

- taking on a customer that can't or doesn't pay;

- ordering too much stock;

- paying suppliers early;

- non-monitoring of overheads;

- poor inventory control (theft/damage etc);

- offering customers lengthy credit terms;

- employing salespeople who wait for the phone to ring;

- paying too much tax by doing tax planning with your small business accountant.

5: Wellness

To be all that you can be with your business and to help it flourish with wellness, use your small business advisors to:

- prepare a strategic plan;

- have solid accounting systems using the cloud such as Xero;

- perform 3 way budgets and get them to report to you on those with virtual CFO reports that aren't just numbers but also meaningful insights that you can understand and give you a platform to take action.

- be your eyes and ears when it comes to anything small business;

- provide advice on how to increase your business valuation.

CONCLUSION:

When you think about it, a business has a spine that often needs some attention when it starts to ache. You can take the quick and cheap way to get relief or you can decide to do it well and work on it regularly by getting sound advice.

Which way do you want to pursue?

.png?width=100&height=100&name=COVID_Safe_Badge_Digital%20(002).png)